Disruption became a catch phrase before the COVID-19 pandemic, but wow – we didn’t know what disruption was till March 2020! A global pandemic was never on the list of threats in strategic planning sessions pre-2020, but you can bet your bottom dollar it is now.

Pre-2020 disruption referred mainly to business being done differently, usually as a result of some technological innovation. Back in my youth, we bought stuff on ‘Lay-By’, where you reserved an item, which the store held for you, and you paid for it in instalments. Once you made the final payment, you took your (usually quite expensive) item home.

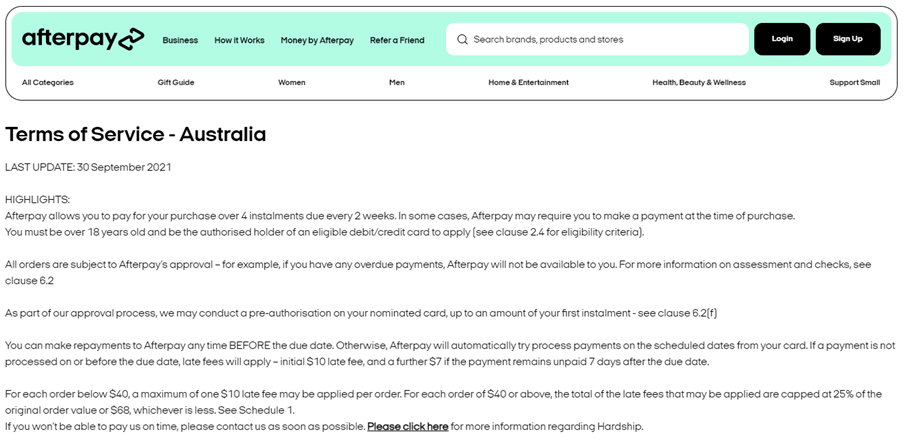

About 3 years ago – enter Buy Now, Pay Later (BNPL) services like Zip and Afterpay, which in effect were a new form of credit card – with low or no interest, fixed period of payment and a major disruptor to banks and credit card companies. Not surprisingly, in lieu of exorbitant interest rates (most credit cards persist in charging around 20 percent interest, even when the cash rate is 0.1 percent!), the BNPL guys have late fees. Pay off on time and no fee, end up late and get whacked with up to 25 percent of the value of your original purchase (see inset for Afterpay Australia Terms of Service summary)

Must be a good business as they made $70 million in late fees in 2020 and Credit Suisse estimates they will make $107 million this year (www.news.com.au Finance article 11 Nov 2021). Business is SO good, that US based Square (the EFTPOS disruptor to banks and their EFTPOS terminals) is buying the Australian founded and resident business for A$39 billion (Australian Financial Review 2 Aug 2021). And the banks are now looking at how they do business with their own BNPL products coming through and revising their EFTPOS terminal services.

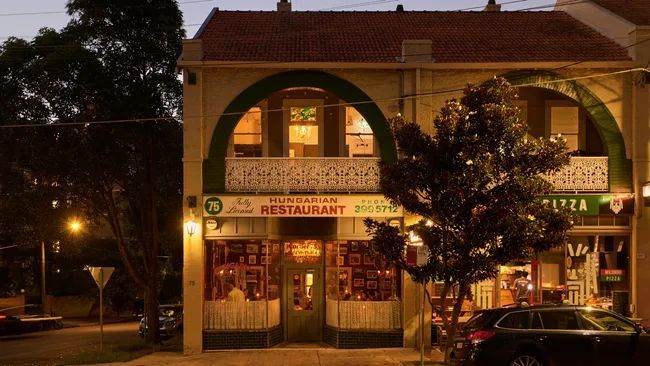

And according to the same news.com.au article, Afterpay is moving into hospitality with a 160 pub group, Australian Venue Co, partnering with Afterpay to offer ‘Dine Now, Pay Later’ in their venues. And they also quote Zip, an Afterpay competitor offering BNPL in partnership with a 10,500 childcare centre operator Xplor Education.

My six most hated words in strategic planning are ”We’ve always done it that way”. And examples like those above, and a global COVID pandemic, have shown that you must be flexible and responsive to any form of disruption.

Crisis Management Planning

Good crisis management planning is critical for survival in the 21st century. Disruption can also occur in old fashioned ways – fire, flood (just check the weather forecast this month), ‘The Great Resignation’ (sweeping the world this month), staff shortages in hospitality generally, legislative changes and reputational issues (especially related to gaming and data privacy).

Is your organisation prepared to handle a crisis that could not only disrupt your business, but potentially kill it for good?

X Do you have a Crisis Management Plan which dictates what to do during a crisis?

X Do you have a Business Continuity Plan, which spells out how your business will continue to operate during or after a major crisis?

X Do you have a Business Recovery Plan that is the roadmap to returning to whatever new normal is possible, after the crisis has passed?

If the answer to these three questions is No, then you are ill prepared to survive any storms you might encounter in the business ocean. Not to say you won’t survive, but you have a much better chance if you plan – during a period of no stress or impending doom - how to respond to any and all challenges.

Just ask those clubs that burnt down over the past few years that had none of the plans mentioned. How easy was it to navigate a way back? Would it have been easier if you had a plan in place?

What about businesses in flood affected areas? If you have a plan, you can respond so much more quickly, confidently and know where you are going from the outset. So, at your next Board or management meeting, set a date to do some crisis management planning.

Never let a good crisis go to waste – Sir Winston Churchill

As many businesses have discovered, especially as a result of the impact of COVID-19, there are different ways of running your business, when you are forced to. With the impact of staff shortages, The Great Resignation and continued closed international borders exacerbating the lack of staff, there is upward pressure on pay rates – especially in hospitality. Reports of pay rates of $40 – 50 per hour for front of house staff, and even sign on bonuses of up to $1,000 are being seen around the country (https://www.theaustralian.com.au/commentary/critical-labour-shortage-is-leading-to-skyrocketing-hospitality-wages).

How do you respond to these sorts of pressures? Some clubs, pubs and restaurants were able to retain the bulk of their staff through the last four month shutdown in NSW, and some weren’t able to, resulting in an exacerbated labour market. Nowhere is this exemplified better than the WhiteNow website hosting around 130 positions vacant - at all levels in our industry – that industry is struggling to fill.

A natural consequence of this labour shortage is to review your operations, products and services and see if you can restructure your business to a more efficient, stream-lined or possibly pared back operation. Time to disrupt your own business!

Here are five questions you should ask yourself about your business –

- Do we need such a wide range of products or services? This could be items on your menu, number of beers on tap, the size and range of the wine list etc.

- Do we need to maintain the same size venue, especially at post COVID trading levels? With reduced patronage, will we ever return to pre-COVID trade levels and visitations, and if not, do we need to rethink our premises?

- Are we maximising our staff rostering to ensure good service at the right cost? Can we reduce things like excessive staff or excessive overtime with better rostering?

- Is there some new technology we can utilise to offer new, different or better services that we haven’t offered before? For example, some venues are going to customer self-service ordering with tablets to reduce staffing levels and improve efficiency.

- Are our technology, data and operating systems secure from cyber-attack? Are we vulnerable to a Ransomware attack, are our firewalls up to scratch and do we handle all our confidential information as securely as we can?

There will possibly never be a better time to review what your business offers and how you do things. So long as you focus on why you do what you do, the how can and must evolve to ensure a viable, sustainable future. Our customers are more prepared than ever to accept, if not embrace, change given the experience forced upon them through the pandemic and all its associated changes.

Disrupt your own business model now! And if you need a hand, or some informed guidance, contact Ron Browne 0414 633 423 or ron@extrapreneurservices.com.au