Are you practising Due Diligence?

Act in Good Faith, Best Interests and for Proper Purpose

Are you practicing Due Diligence?

Directors and officers of companies – For Profit and For Purpose (not-for-profit) – are all compelled to always act in the best interests of the company. Under the Corporations Act 2001, Section 1.5.5 relating to Company Directors and Company Secretaries, clause 5.3 addresses the Duties and Liabilities of directors. For me, the salient points for today’s discussion are:

X Act in good faith

X Act in the best interests of the company

X Act honestly

X Exercise care and diligence

Furthermore Section 180 - Care and Diligence – civil obligation only, states -

A director or other officer of a corporation must exercise their powers and discharge their duties with the degree of care and diligence that a reasonable person would exercise if they:

(a) were a director or officer of a corporation in the corporation's circumstances; and

(b) occupied the office held by, and had the same responsibilities within the corporation as, the director or officer.

Diligence is defined in most dictionaries as “working carefully and with a lot of effort” to ensure the desired outcomes of any project are achieved. In the boardroom context, I believe it advocates thorough examination of any project or issue, canvassing additional expert advice, and ensuring all positives and negatives have been explored, before making any decision.

In club board rooms over the years, I have observed misguided diligence. Let me give you an example.

The club board spends around three hours arguing with the manager about a proposed 20 cent per schooner price increase, yet the same board took five minutes to sign off on a $500,000 club extension project. My understanding was that there was no formal tender for this project, just a persuasive salesperson who was able to convince the board they would do a great job, at a great price and then they closed the deal with a handshake, and very scant contract paperwork.

Another club board signed off on a joint venture development of their golf course without fully understanding the details of the contract and continued to trade the club the way they always had – at a loss – for much of the early development project period. The developer had signed documents to provide supporting finance to the club, to allow them to continue trading even after their own reserves were exhausted.

The bottom line, the club ended up spending more than the profit they we due from the joint venture project so subsequently, the developer took possession of the club’s property. The club got a nice shiny new clubhouse out of the deal, and a few hundred new residences on site, which would help future trade, but they didn’t own anything and were in debt.

What could have helped this club, and any club contemplating a joint venture in the future, is to do proper due diligence on the project before signing off. The board thought they knew what they were doing and negotiated what they thought was a great deal for their club and members, but they had insufficient knowledge, skills and experience to lock it in tightly and understand their obligations to the deal.

Regardless of the proposed project, strategy or operation, when care and diligence is exercised the parties to the project understand the limits of the project e.g. the timeframe to completion, the cost to all parties, the potential pitfalls (contingencies), the consequences if any pitfalls occur, the potential rectifications and costs if it does need to be done (hopefully within the contingency budget).

Governance Oversight Due Diligence

The examples above relate to construction and development projects and highlight the pressing need for care and diligence to ensure the projects are delivered as budgeted and as scheduled. The other key area of care and diligence required by boards is in the key area of governance oversight. Here due diligence is a many faceted beast, covering but not limited to –

X Ensuring all policies and procedures are in place

X Work Health & Safety (WHS) including Psychosocial areas

X Strategic Planning

X Financial Viability

X Succession Planning

X Environmental Policy

X Gaming Management

X Risk and Crisis Management

X Harm Minimisation

X Stakeholder Relations

X Reference checking staff pre employment (inc. Police Checks)

X Anti Money Laundering/Counter Terrorism Financing (AML/CTF)

X Cybersecurity

X Marketing and Communications

X Procurement

X Reputation and Image

X Compliance Registers

X Code of Conduct

Oh no, I hear you cry. I don’t know how to do all that! I am just a volunteer and want to help my club by being on the board, but I didn’t realise there was so much responsibility and work involved. HELP!

Here are 3 Tips to ensure great Due Diligence

1. Get expert advice.

There is a little secret that I will share with you now, that will put your minds at ease.

If I don’t know something, or how to do something,

I ask a Subject Matter Expert for advice and guidance.

The smart people are those who know what they don’t know and seek help and advice from those who do. None of us are Google – we don’t have every answer to every question – not even Barry Jones did, for those old enough to remember him.

The greatest exercise of Due Diligence is to ask for advice and guidance from those who know what is required, for any situation. I constantly advocate to directors for example – It is your responsibility to ensure the organisation has all the policies and procedures in place that it requires to comply with all legislation the organisation is governed by. But you do not need to write them!

For legal compliance, consult with your legal counsel. For Financial compliance, consult with your accounting firm and auditor. For Gaming compliance consult with ClubSAFE, BetSafe or Liquor and Gaming. For Work Health & Safety including prevention of Bullying and Harassment, Workplace Violence and other Psychosocial risks, consult with a Human Resources (HR) consultant. For Cybersecurity, consult with an Information Technology (IT) company or consultant. And so the list goes on and on.

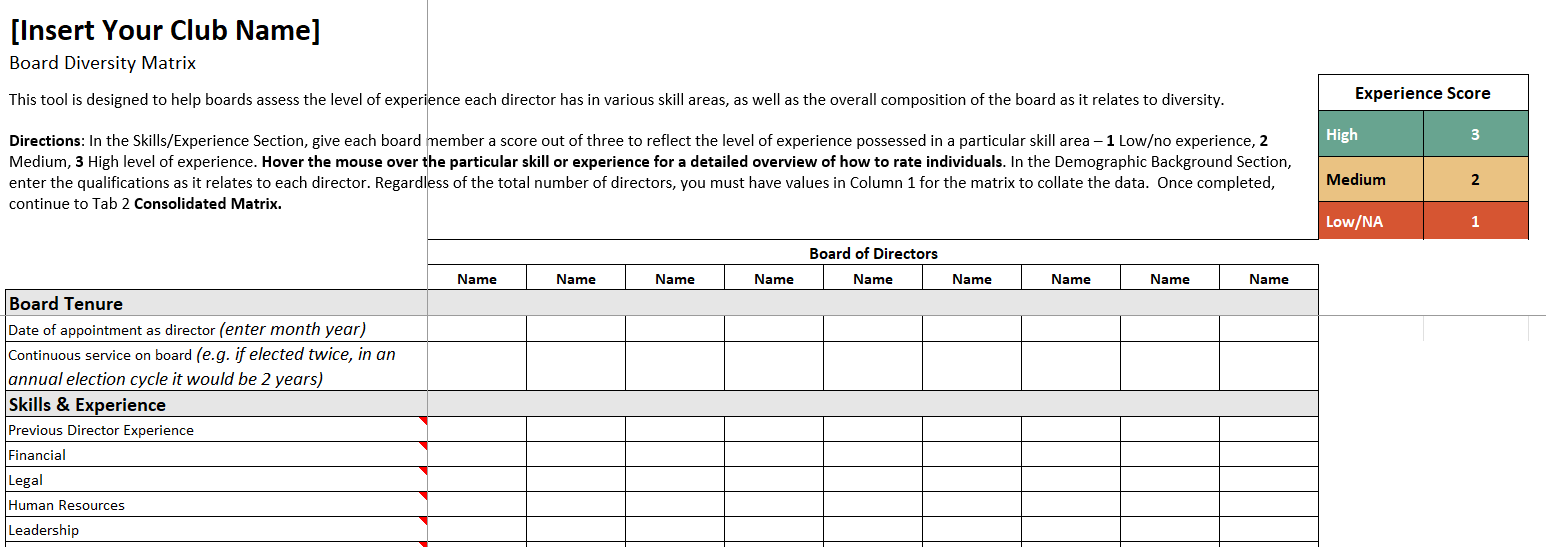

2. Recruit for diverse skills on the board.

Many of your potential directors have skills in specific areas – law, finance, real estate, marketing, logistics, human resources, construction etc. In the club industry you can appoint directors to your board for a specific skillset and experience, without them being elected by the members, to add that expertise to the board.

This allows the board as a whole to benefit from their expertise, to ensure you exercise appropriate due diligence in that specific area. They can lead a sub-committee, for example, a director with accounting skills can lead the Audit and Finance Committee of the board. This should ensure care and diligence born of industry knowledge is leading the rest of the board to execute their due diligence in the financial area.

Once the Audit and Finance Committee have done their work, they should review their work with the organisation’s accountant and or auditor, to ensure they have been comprehensive in their due diligence, before they present to the board. The same process can apply for WHS, AML/CTF and so on, to ensure all areas are properly addressed.

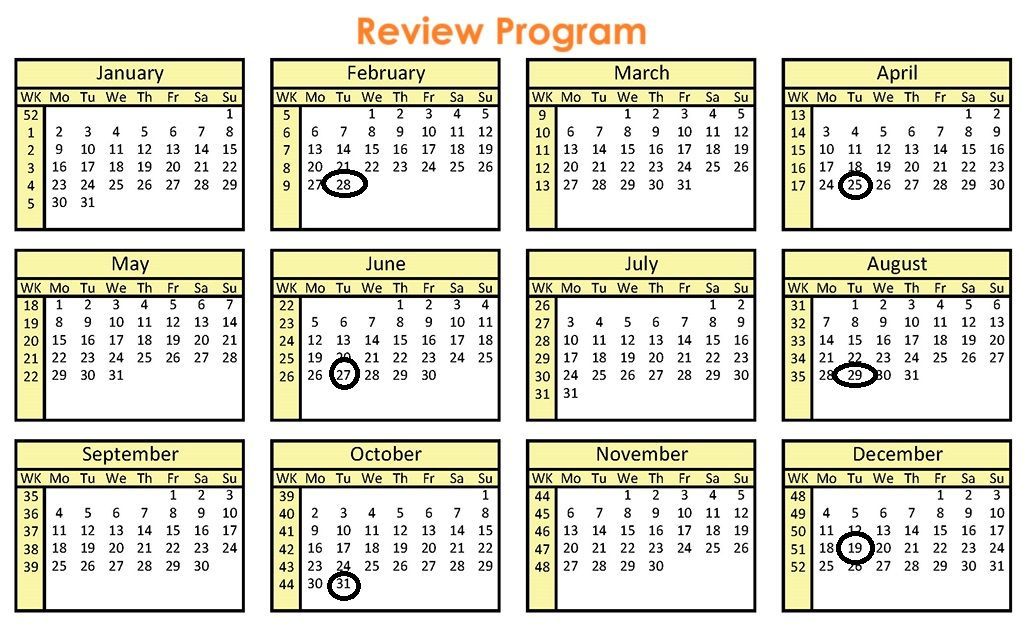

3. Set a Review Program for Board meetings.

Many organisations only have four or six board meetings a year, and now the club industry is no longer required by law to hold monthly meetings, many have reduced to six per year. In order to ensure everything requiring due diligence and care is addressed, set a schedule to review a different area of Governance oversight at each board meeting.

Finance and Audit reports probably occur at every board meeting as your fiduciary duties require directors to have their finger on the financial pulse of the organisation at all times. Other areas may have little or no attention paid to them during the year unless included on the agenda from time to time. Once all areas of oversight have been identified, policies and procedures put in place, then review of the status of each area should be done at least annually, for the lower importance issues, and potentially quarterly for the more critical areas of concern.

The dual benefit of setting this sort of regime in place is that your governance oversight will step up to a higher level and if challenged by any authority, you will have board meeting minutes providing an audit trail of your due diligence throughout the year.

For more information contact Ron Browne Managing Consultant 0414 633 423 or ron@extrapreneurservices.com.au