Cashflow is King...

Now is the right time to be completing budgets.

For most organisations, the financial year starts 1 July, so now is the right time to be completing budgets. Where cash was once king, cashflow is the mantra as it is all about cashless trading for most people these days. ANZ Bank has already announced it’s plans to withdraw (pun intended) its ATMs as they no longer wish to be in the cash handling business.

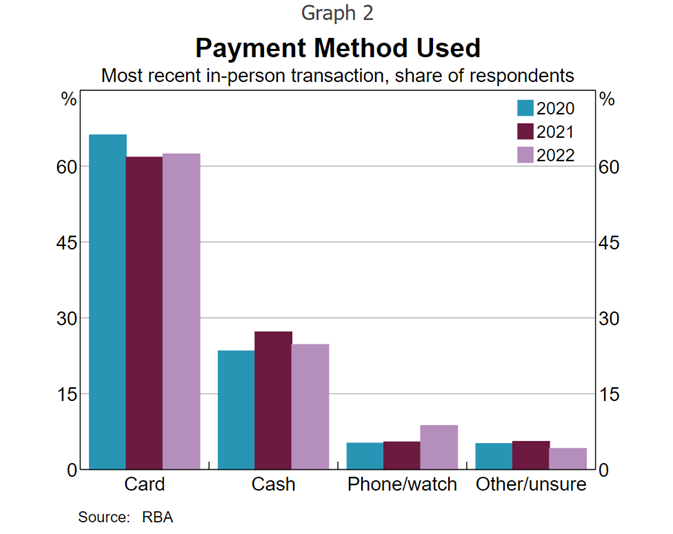

Most people under 50 rarely use cash for their transactions preferring card, phone (card app) or even a wrist watch device to pay in store.

Nearly 40 percent of payments in 2019 were made online with many of these made on mobile devices (phones and tablets with an app). So managing your cash flow is an essential part of managing your business.

In clubs and pubs, a large percentage of payment are also now made by EFTPOS (Electronic Funds Transfer at Point Of Sale) with the Reserve Bank's Consumer Payments Survey (CPS) showed that the share of total retail payments made in cash fell from 69 per cent in 2007 to 27 per cent in 2019 (Caddy, Delaney and Fisher 2020).

Budgets

Budgets are best guess projections of both income and expenditure and in my experience, it is pretty easy to be accurate with expenditure, but much harder to predict income. With the odd exception, the occasional extraordinary expenses, plotting your budget for wages/salaries, fuel, power, water and supplies can be fairly simple. Monthly variances must be calculated – like peak sales in holiday periods for destination type businesses (coastal locations in particular or the ski fields with their peak in winter) or drops in revenue with inland businesses when people leave town for other locations over Christmas and Easter, for example.

Budgets give you a plan to base purchasing, promotional and staffing decisions, so that you aim to maximise the operating profit of your business. They also afford you the ability to (try to) ensure you have the right amount of funds available when you need them – for payments of suppliers, staff and repayments of loans etc..

Budgets should be developed around historical data, market conditions and economic changes that may impact on the organisations revenues, like interest rates, unemployment status and supply costs.

The budget should be created by management and presented to the board for approval, before the start of the next financial year. Once approved the management will have confidence to know that they can operate the business within the bounds of the approved expenditure, with the resulting income monitored against the KPIs (Key Performance Indicators) set by the board.

Capital Expenditure

Capex (the standard abbreviation of capital expenditure) is something that many businesses do not necessarily budget for and then find they need to fund. Most capex is around high value items that may be required to allow the business to operate or to increase its ability to generate revenue – for example extensions to premises, replacement of major infrastructure, plant (like refrigeration or air conditioning systems) or equipment (like poker machines in clubs and pubs).

Where cashflow is strong and capital reserves have been built up, then budgeting for the investment of capital on these sorts of items is a simple matter of scheduling, when the necessary expenditure needs to occur. Where a business is struggling and has low or no reserves, capex might need to be funded from cashflow or through a loan facility.

Interestingly, in the club industry, many clubs believe they need to make major capex investments in one go, when scheduling them over a period of months or years can take cashflow pressures off the organisation. Where possible, capex investments should focus on revenue generating investment first and nice to have investments last.

In most cases, new carpet and furniture will not really generate additional revenue, where upgraded kitchen, bars and gaming rooms can definitely generate more income.

Accruals

One item overlooked by many businesses are accruals for essential equipment to be replaced over time. A classic in clubs and pubs is HVAC (Heating, Ventilation and Air Conditioning) systems. These have limited lifespans, usually around 10 – 15 years, after which efficiency drops dramatically and maintenance costs rise proportionately. Businesses, where possible, should be accruing the funds to replace these items over the serviceable life of the plant. If funds identified as Depreciation costs can be accrued then once the capital item is effectively written off, the reserves should be available to fund the replacement.

Easy in theory but harder in practice, however I would advocate that a discussion with your accountant, to see how this might be set up for your business, would be a valuable exercise. My disclaimer comes in around now….

I am not an accountant and my comments are born only on my professional business experience, so PLEASE talk to your accountant or financial adviser for professional advice in all matters relating to budgeting, capital expenditure and accruals.

Across the state, you can use your local accountant, however the hospitality industry is well served by many companies that are industry experts such as PKF, Russell Corporate Advisory and Pitcher Partners amongst others.

For more information contact Ron Browne, Managing Consultant 0414 633 423 or ron@extrapreneurservices.com.au